Trade the most popular stocks on the MT4 platform, which is loved by traders. Go long or short at your discretion.

Why trade share CFDs?

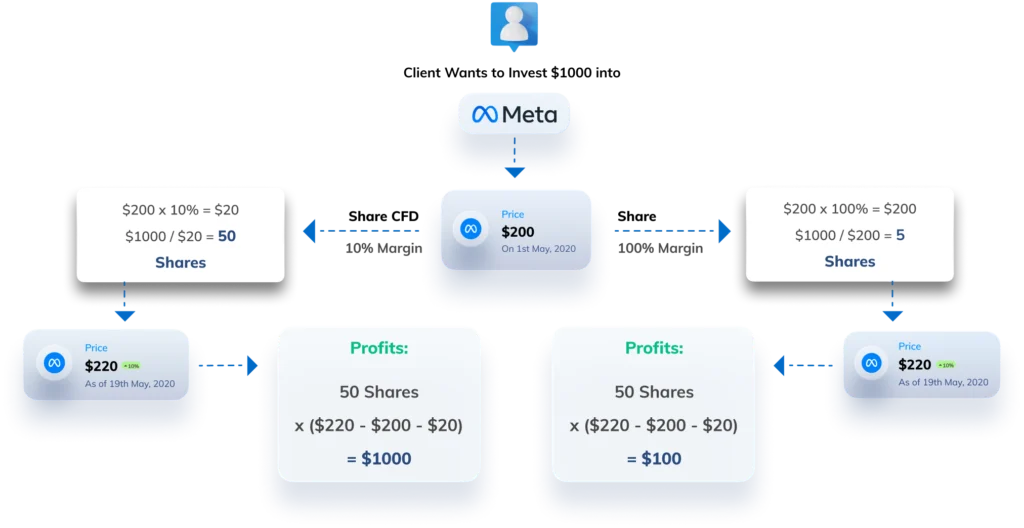

One of the biggest benefits of trading share CFDs is that you only need a small initial deposit to fully capitalize on share price movements.

*The above examples are for illustrative purposes only. CFD trading involves high risks and may not be suitable for all investors.

Why trade stock CFDs with TMGM?

Trading multiple stock classes

Direct Market Access

Real-time execution speed

Low fees

dividend

Competitive prices

Leverage up to 1:20

Go long (buy) or go short (sell)

Frequently Asked Questions

How do I start trading CFD stocks?

You can start trading CFD stocks by opening an account with us today. With TMGM, you can learn the nuances of CFDs through a demo account before committing to live trading.

To get started, you should choose a platform and make sure you know how to place orders, read charts and indicators, and use risk management tools.

How much capital do I need to start trading stock CFDs?

When you start trading CFDs, you must meet your broker’s minimum deposit requirements. At TMGM, you need $100 to open an account. The amount of capital you need will depend on your plans. If you’re just learning to trade, $100 is enough to get started. However, if you want to open larger positions and meet your broker’s margin requirements, you may need more funds.

How do I start trading CFD stocks?

When you trade with TMGM, you don’t own stocks. A CFD is a derivative product that tracks a stock but doesn’t give you any ownership rights. Unlike options or futures, you don’t have the right or obligation to buy or sell a stock outright. CFDs simply track the price movements of the underlying stock, so you can benefit from price fluctuations without having to buy the shares.

Are CFDs better than stocks?

There’s no single correct answer when comparing CFDs to stock trading. These instruments serve different purposes. Stocks give you ownership of an asset, allowing you to enjoy benefits like dividends and long-term gains. CFDs don’t offer the same investment advantages, but they allow you to track the market with limited capital, making them more suitable for day trading and short-term strategies.

Therefore, if you’re an active trader with limited funds, CFDs may be more suitable for your goals than stocks.