FOREX

Trade CFDs on over 50 forex pairs and benefit from tight spreads and lightning execution.

Why trade CFDs on Forex?

The foreign exchange market is the world’s largest and most liquid, with a daily trading volume exceeding $6.5 trillion. By comparison, markets like the New York Stock Exchange only trade a little over $2 billion daily.

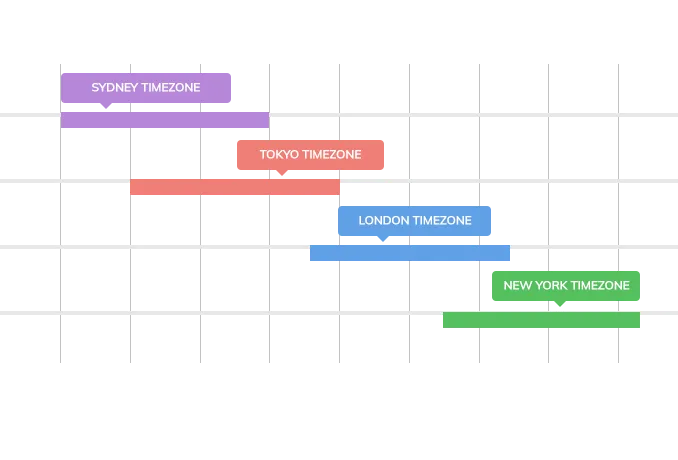

The market is open 24 hours a day, 5 days a week, catering to all traders, regardless of where you live in the world.

Why Trade Forex with TMGM?

We always ensure you get the best trading conditions with our deep liquidity and lightning-fast execution technology.

Why choose TMGM for Forex trading?

Over 50 foreign exchange pairs

Spreads starting from 0.0 pips

10+ Tier 1 liquidity providers

NY4 server

Leverage up to 1:1000

Allow all policies

No requotes

Trusted and regulated broker

Transparent spreads

No hidden costs when you trade

Major Pairs

The most traded pairs with deep liquidity and tight pricing.

| Symbol | Bid | Ask | Action |

|---|

Cross Pairs

Pairs that do not include the U.S. Dollar, often used to diversify FX exposure.

| Symbol | Bid | Ask | Action |

|---|

Exotic Pairs

Less liquid pairs that may have wider spreads due to lower market flow.

| Symbol | Bid | Ask | Action |

|---|

Frequently Asked Questions

How do I start trading Forex?

The first step to starting forex trading is finding a reputable broker like TMGM. Before opening a position, you should learn how to assess the market and manage your trades.

It’s also a good idea to limit your leverage until you’re confident in your strategy and can properly use risk management tools.

How much capital do I need to start Forex trading?

Thanks to leverage, you don’t need a large amount of capital to trade currency CFDs. The minimum deposit with TMGM is $100. If you want to use leverage, you may need to meet margin requirements, but as long as you meet the minimum deposit requirements, you’re good to go.

What economic factors may affect foreign exchange rates?

The price of foreign exchange can be affected by the economic situation between two countries. International conflicts, trade agreements, changes in tax laws, and other factors can also influence the market, as can changes in government or central bank policies and interest rates.

How is Forex trading different from trading the stock market?

While forex trading involves currencies, the stock market involves trading shares issued by companies and funds, encompassing a wide range of stocks. The currency market is global, while stocks are typically limited to a specific country. However, the most popular brokers offer CFDs on both stocks and currencies.

Are foreign exchange transactions taxable?

Many countries consider forex trading a legal way to earn income. Therefore, any profits you make from the spot or CFD markets are subject to income tax. Calculate your profit and loss for the year. If you have a profitable year (if the difference between your profit and loss is greater than $0), you will be taxed on your total annual profit.

What is equity in forex trading?

In forex trading, equity is the amount of capital in your account. If you’re not trading anything, your equity is the same as your account balance. If you have open positions, the concept is slightly more complex.

In these cases, equity is the sum of your current trading profits minus your losses, plus your account balance. Therefore, your equity can fluctuate minute by minute.

What is Free Margin in Forex Trading?

Free margin refers to the amount of money in your account available for trading at a given moment. Think of it as the total amount you can withdraw from your account. Brokers have margin requirements, which are the amount of capital you must contribute to leveraged trading.

If you use a 1:10 leverage requirement and have an open position worth $10,000, you must maintain $1,000 in your account. If you have $5,000 in your account, your free margin is $4,000. If you close your $10,000 position, this $1,000 becomes part of your free margin.

What is the daily foreign exchange trading volume?

The foreign exchange market is the world’s busiest financial market. Approximately $5 trillion changes hands daily. This total may be slightly higher or lower depending on world events, market news, and other factors.

The most traded currency pairs in the market include EUR/USD, USD/JPY, GBP/USD, and AUD/USD.

Is Forex a Contract for Difference?

Contracts for Difference (CFDs) track spot forex pairs. However, CFDs don’t require the purchase and holding of currencies. This makes CFDs more convenient than spot trading for retail traders.

What is the foreign exchange purchase limit?

A buy limit price is a set price at which a trader wants to execute a trade. The trader places a buy limit order and waits for the market to reach that price. If it does, the position is automatically opened.